What is a balance sheet?

TLDR: A balance sheet shows: Assets = Liabilities + Shareholders’ equity

In a nutshell

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It’s called a balance sheet because it shows the balance between the company’s assets, liabilities, and shareholders’ equity:

- Assets: Cash, inventory, buildings, equipment, accounts receivable, etc).

- Liabilities: Debts and obligations to other parties (loans, accounts payable, wages, etc).

- Shareholder’s equity: The value left after Assets – Liabilities.

Main components of a balance sheet

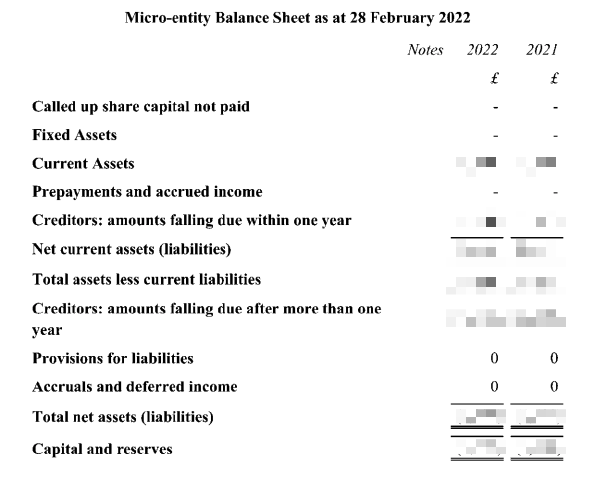

Here’s an Micro-entity example balance sheet submitted to Companies House:

Let’s go through each item in that list.

This is capital that a business expects from shareholders for selling its shares but which it is yet to receive (What is called-up share capital?).

Fixed assets

Assets that the business expects to gain value from over a longer period than one year (What is a fixed asset?).

Thanks for your comment 🙏. Once it's approved, it will appear here.

Leave a comment