What is VAT?

In a nutshell

VAT (Value Added Tax) is a consumer tax that the UK government adds for goods and services consumed in the UK. VAT is an essential source of income for the UK government that helps fund public services like schools and hospitals.

At the time of writing, the VAT rate is 20%, which means that for every £1 you spend as a consumer on certain goods and services, you’re indirectly paying an additional 20p as VAT. So if you buy something for £10 from a VAT-registered business, you’re probably paying £2 tax (20% of £10) to the government.

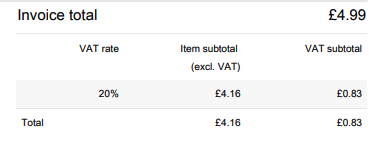

In practice, businesses add the 20% VAT rate to their goods or services and they are the ones responsible for collecting VAT and giving it to the government. For example, if you bought an item for £4.99 from a VAT-registered business and you requested an invoice from them, you’d see something like this on the invoice:

This means that although you paid £4.99 to the seller, the seller only keeps £4.16 of that amount. They give the remaining £0.83 (20%) to the UK government.

When is your business legally obliged to register for VAT?

When your total VAT taxable turnover for the past 12 months exceeded £85,000 (The VAT threshold).

Legal responsibilities of a VAT-registered business

- Include VAT in the price of all your goods and services at the correct VAT rate.

- Keep a record of how much VAT you paid for business expenses.

- Keep a record of how much VAT you charged for your goods and services.

- Submit a VAT return (record of how much VAT you paid and how much you charged) to HMRC (usually every three months).

What is a VAT return?

A VAT return is a form you fill in and submit to HMRC to tell them how much VAT you paid for your business expenses and how much VAT you charged other businesses. You typically need to submit a VAT return every 3 months.

The amount of VAT you need to pay to HMRC follows a simple formula:

- Workout your balance: Balance = Amount of VAT you charged – Amount of VAT you paid

- If the balance is positive, you must pay this amount to HMRC. If the balance is negative, HMRC will pay you this amount.

How do I file a VAT return?

You can use the HMRC website to file your VAT return or use an accounting software like FreeAgent.

Other notes

- The more goods and services consumed in the UK, the more VAT the UK government earns.

- The UK government can enforce different VAT rates for different goods or services. This enables them to reduce the VAT rate on certain goods (e.g., vegetables 😂) to promote them or to increase the VAT rate on other goods (e.g., cigarettes) to discourage them.

- If you’re VAT registered, you can claim VAT back. But you also have to charge VAT for everything you sell. Thus, it makes you 20% more expensive.

Questions

- What are the different VAT schemes?

Sources/links

Thanks for your comment 🙏. Once it's approved, it will appear here.

Leave a comment